According to statistics from the Family Firm Institute, family companies generate 70% of annual global GDP and create 50–80 % of jobs in the majority of countries worldwide.

It is futile to strive for platinum standard human resource management with silver standard family governance. Mahatma Gandhi had aptly said, “Be the change that you wish to see in the world.” What really happens and what can be the best way forward?

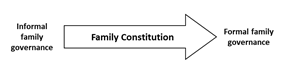

All Indian business families have their family rules, do’s and don’ts, moral standards, succession process, mechanisms for resolving differences, etc. Collectively, this is referred to as principles of family governance. These principles are generally neither codified nor documented but supposedly understood. Lately, some business families have realized the importance of codifying and documenting the principles of family governance in the form of the Family Constitution. As the family grows and hopefully as the business grows, the likelihood of dilution in family governance is reduced when it is agreed and documented in the form of a Family Constitution.

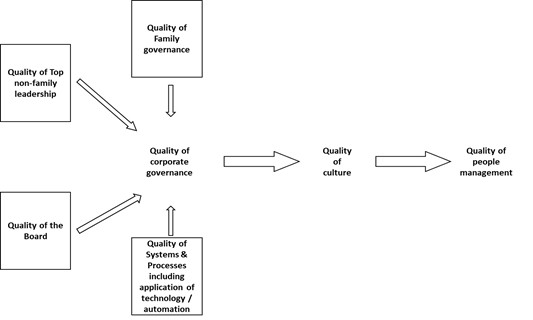

Family governance has a major bearing on corporate governance.

If a business family does not value simple living and likes to exhibit wealth, then the organization would struggle to consistently keep its operational costs or project costs down. If a family values frugality and avoids show of wealth, the family-managed organization would also exhibit such a culture without any difficulty. If a business family loves privileges of life (example: bypassing the queue in a public place, getting VIP treatment) the organization would likely consider the laws of the land as obstacles. If a business family respects the rules that are followed by other ordinary citizens, the organizational culture would be to view laws as necessities.

If a business family speaks in many voices, or there are visible differences in the worldview among the family members, or there is poor communication among the family members, such a situation puts pressure on corporate governance. If business family members are aligned in terms of their value system, manage their differences quickly and with mutual respect, and don’t allow such differences to be exposed to non-family executives, the corporate governance processes are unlikely to be compromised.

It is futile to strive for gold standard corporate governance with bronze standard family governance.

Many types of Indian family-managed organizations exist. It is not difficult to imagine which type has a better chance of succeeding in the long run.

Most large Indian family-managed companies invest in establishing business processes and systems, including the application of the best technology and automation systems. These influence corporate governance. For example, when HR processes are policy-driven, automated workflow-based, then the chance of manual intervention to make an exception to the policy for a particular employee gets reduced.

The establishment and sustenance of high standards of corporate governance are also dependent on the quality of top non-family leadership. If they respect the rule of law, then corporate governance can be of a high standard. Otherwise, it is likely to be compromised, which would impact organizational culture adversely. If a CEO acts swiftly and boldly against a high performer with unacceptable behavioral traits that breach the company’s code of conduct, corporate governance gets strengthened and the standard of people practices gets enhanced. If the family business leader prevents the CEO to take such an action citing ‘compelling reasons’, it sends a wrong message to the rest of the organization. On the other hand, when such an action by the CEO is supported by the family business leader who says, “Don’t worry, I shall be with you to manage the consequence”, it sends the right message to the rest of the organization. Finally, the quality of the Board is important. In some family-managed companies, the independence of the Board members is not strongly established, and the quality of the Board members is sometimes iffy. In such a circumstance, (a) there is a weak check & balance between non-independent Board members (family business leaders) and independent Board members and (b) Board oversight is not of high quality. Happily, the situation is improving with the realization that a virtuous cycle is created between the quality of the Board and the reputation of the enterprise, each enhancing the other. This attracts top talent, improves organizational culture, and raises the quality of people management continually.

For more details please contact us: https://eumatterconsulting.com/business-family/